Market Overview: Is Your Portfolio an SUV or a Race Car?

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s chief research and investment officer.

The Morningstar US Market Index rose 0.9% last week as earnings season picked up. Financial services companies were an important driver, as the results from the index heavyweight Bank of America BAC were well received. Morningstar’s Investment Management team continues to see opportunities for US banks and many other parts of the investment universe, although it appears that the US market is much higher in the index. You can find more information in our recently published Global Convictions document.

On the other hand, energy has fallen significantly (2.7%), reversing the gains seen earlier in the month, when the price of Brent Crude oil fell to $73 a barrel. This reduction is in line with the publication of the World Energy Outlook of the International Energy Agency, which suggests that there will be an excess supply of energy for the foreseeable future due to the transition to other renewable sources. . Morningstar recently published a report on the US renewable energy market.

You can follow the earnings calendar here and find out what Morningstar analysts are making of the results here.

As the US presidential election approaches, we may be bombarded with confident predictions about how each outcome will affect financial and investment markets. Such predictions are dangerous, for two reasons. First, politics is inherently reactive to events, and administrative priorities can change dramatically. Second, our political opinions tend to enter our predictions, as we find it difficult to imagine that the party we oppose will benefit the country, so we naturally weigh more than the possibility of opinions that agree with ours.

Making investment decisions on this basis can lead to surprises that ruin one’s portfolio. To avoid this, make sure that your portfolio is not aligned with one outcome. This can be compared to the difference between driving a race car and an SUV. A race car will get you somewhere fast, as long as the track conditions are predictable, but it will be difficult if the track is wet or winding. On the other hand, an SUV will be slower in perfect conditions but more efficient when the road is rough. It’s tempting to build a portfolio like a well-calibrated race car for your prospects (including political prospects). However, an SUV is a great option, as the future is uncertain.

To determine if you have an SUV or a race car, think about how your career will work if your worst fears about options come true. If such a situation worries you, it may be a good idea to adjust your assets to make your portfolio more flexible and able to withstand whatever we may get in the next few weeks. Morningstar portfolio manager John Owens recently wrote an article about this after a summer visit to Joshua Tree National Park.

The most important news this week may be the release of the Federal Reserve’s “Beige Book” on Wednesday. This bearish assessment of the US economy will be factored into investors’ expectations about the future of interest rates. It can affect bond prices and economically sensitive industries. However, as it competes with the ongoing earnings season and the noise from the polls, only extreme decisions can be widely recognized.

This Week’s Market Highlights and Investment Events

- Monday, Oct. 21: Key earnings highlights from Zions Bancorporation ZION

- Tuesday, Oct. 22: Earnings from GE Aerospace GE, General Motors GM, Verizon Communications VZ

- Wednesday, Oct. 23: Domestic Sales Available, Federal Reserve Beige Book, earnings from Coca-Cola Company KO, AT&T T, Boeing BA, ServiceNow NOW, Tesla TSLA

- Thursday, Oct. 24: First Unemployment Insurance Claims Report, Purchasing Managers Group, New Home Sales, Earnings from American Airlines Group AAL

- Friday, Oct. 25: Standing orders

Check out our weekly calendar of economic reports, consensus estimates, and corporate earnings.

For Full Business Week on Oct. 18

- The Morningstar US Market Index rose 0.89%.

- The best performing sectors were services, up 3.28%, and real estate, up 2.95%.

- The worst performing sector was energy, which fell by 2.74%.

- The 10-year US Treasury note yield remained unchanged at 4.08%.

- West Texas Intermediate crude prices fell -8.86% to $69.37 per barrel.

- Of the 703 listed US companies covered by Morningstar, 490, or 70%, were up, 0 were unchanged, and 213, or 30%, were down.

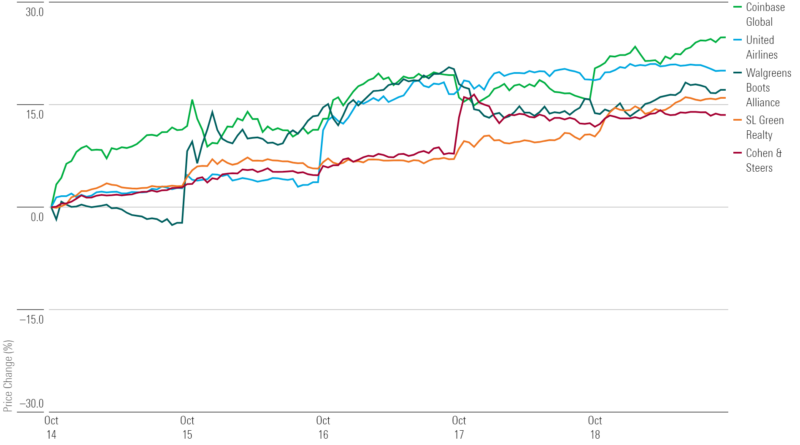

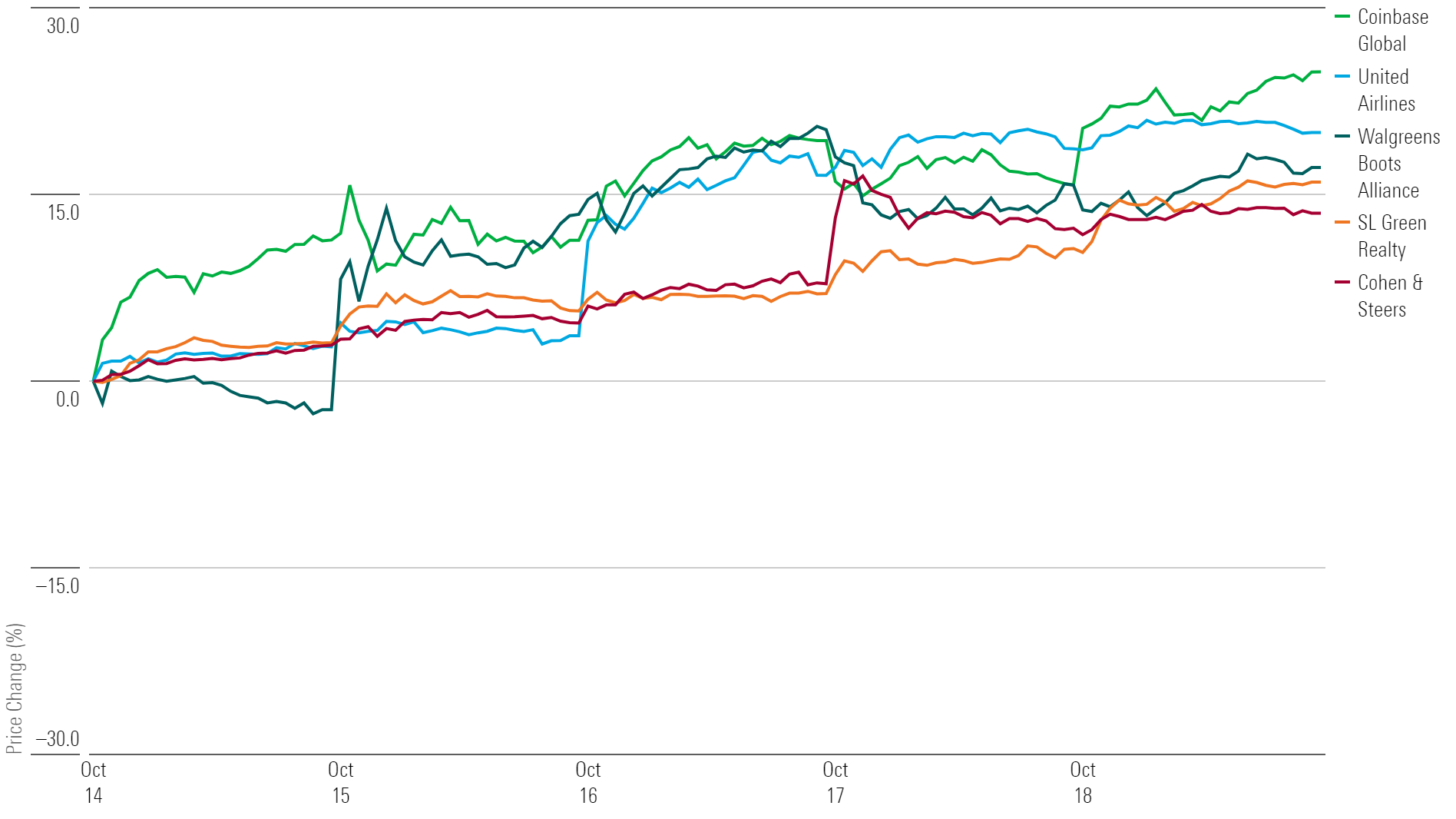

What Stocks Are There?

Coinbase Global COIN, United Airlines UAL, Walgreens Boots Alliance WBA, SL Green Realty SLG, Cohen & Steers CNS

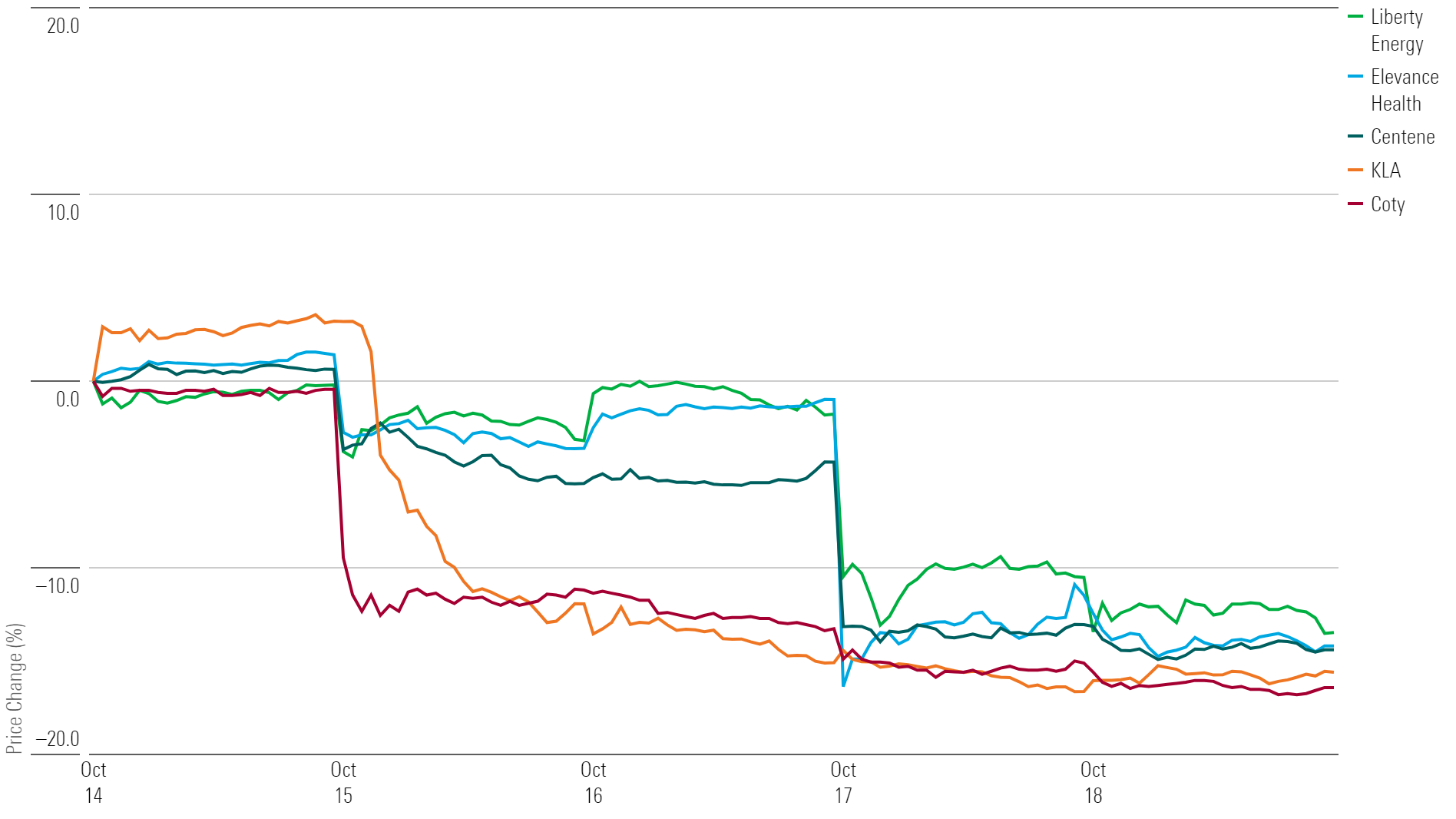

Are Stocks Full?

Coty COTY, KLA KLAC, Centene CNC, Elevance Health ELV, Liberty Energy LBRT

#Market #Overview #Portfolio #SUV #Race #Car